reit tax benefits uk

Ad This company is required by law to distribute 90 of its taxable income to shareholders. REITs are exempt from corporation tax on profits generated from rental income and the income from the sale of rental properties making them a tax-efficient investment choice.

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

For UK resident individuals who receive tax returns the PID from a UK REIT is included on the tax return as Other Income.

. The REIT is exempt from UK tax on the income and gains of its property rental business. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. REIT Tax Benefits No.

In the hands of the shareholder property income distributions PID are taxable as profits of a UK. Explore investment opportunities with CrowdStreet. Dont buy real estate invest in it.

Ad Investing in Real Estate Can Be Lucrative. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. Your REIT Income Only Gets Taxed Once When a typical corporation makes money it has to pay taxes on its profits.

The majority of REITs will therefore have both a tax-exempt business and a smaller residual taxable business. 2 Distributions are not guaranteed and may be funded. If it pays a dividend to.

4 AEW UK REIT AEWU. These REITs are Under 49. A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property.

Corporation Tax is payable on its profits and gains from. With negative real bond yields here is how you can invest for passive income right now. Advantage 3 - Tax Efficiencies.

Wish You Could Invest in the Lucrative Real Estate Market. REITs benefit from some pretty special tax advantages. How to Get the Benefits Without The Headaches.

The benefits are considerable. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT.

A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. A REIT investor REIT can now invest in another REIT target REIT without a.

If completing the return online in the section Other UK Income. AEW UK REIT focuses on commercial real estate in the United Kingdom with 36 properties in its portfolio at a valuation of 24018 million. Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace.

Profits and gains are tax-exempt Distributions taxed in the hands of. REITs benefit from some pretty special tax advantages. A real estate investment trust REIT is exempt from corporation tax on qualifying rental income and gains on sales of investment properties and shares in property investment.

The Government has made the REIT regime more attractive with the changes to the legislation in recent years. A high distribution requirement also protects the UK tax base because the point of taxation for a UK REIT is in the hands of investors where distributions may be subject to.

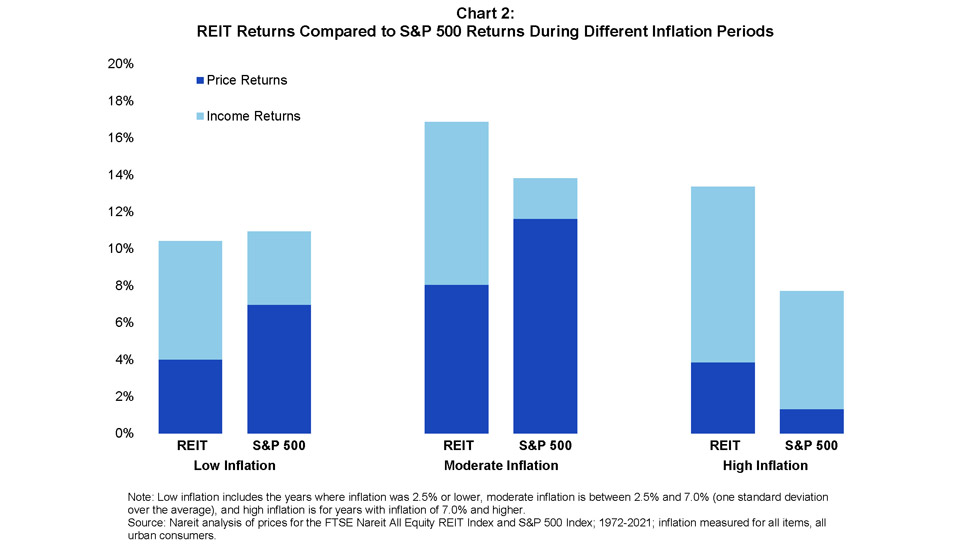

How Does Inflation Affect Reit And Stock Performance Nareit

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

Top Reasons To Not Invest In Reits Seeking Alpha

We Often Get The Question What Makes A Fundrise Ereit Worth Investing In Over The Vanguard Reit Etf Here We Investing Best Investments Investment Companies

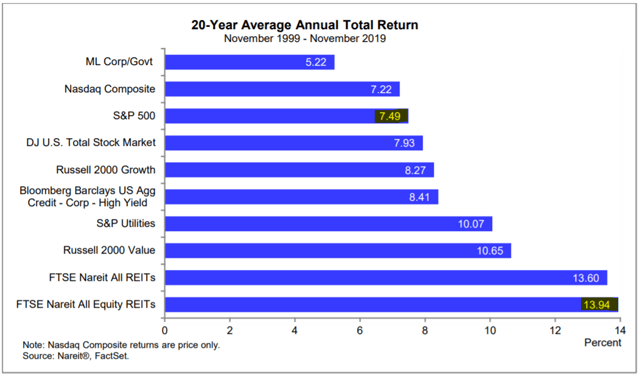

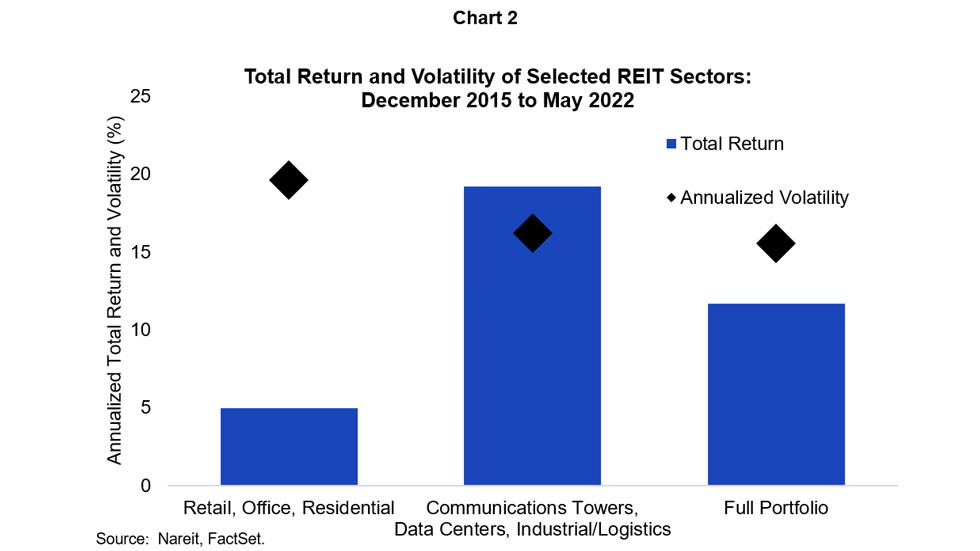

Reits Support Completion Portfolios With Increased Returns And Lower Volatility Nareit

A Short Lesson On Reit Taxation

How To Invest In Reits Does It Make A Good Long Term Investment

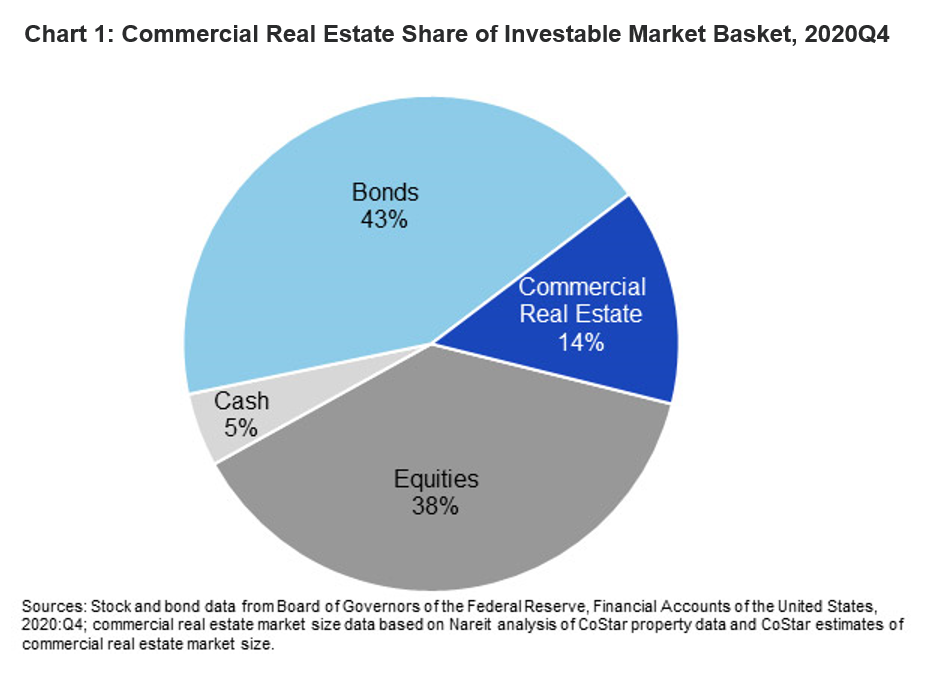

The Role Of Real Estate In Pension Funds Nareit

Reits Support Completion Portfolios With Increased Returns And Lower Volatility Nareit

Investing In Reits Real Estate Investment Trusts Block Ralph L 9781118004456 Books Amazon Ca

7 Types Of Reits Let Us Explore Why You May Want To Invest Too

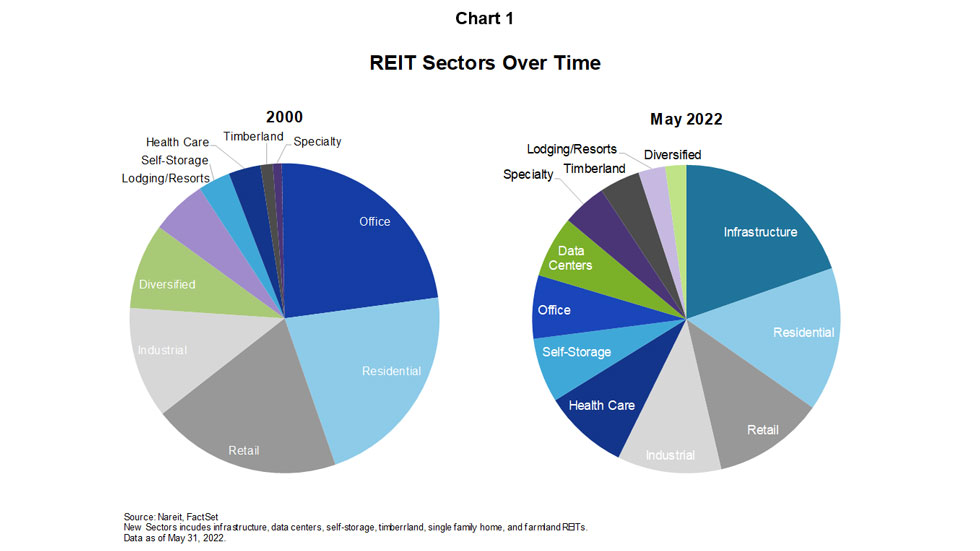

Reits 2021 In Review And What S Ahead For 2022 Nareit

Reit Investing 2022 Beginner S Guide Real Estate Investment Trusts

Reits Vs Real Estate Mutual Funds What S The Difference

5 Types Of Reits How To Invest In Them

A Short Lesson On Reit Taxation

Reits A Force For Good Crestbridge

Reit Investing 2022 Beginner S Guide Real Estate Investment Trusts